- eSocket.POS Developer Guide

- Introduction

- 1. Interface specification

- 2. Java API

- 3. XML Interface

- 3.1. Overview

- 3.2. Using Esp:Interface

- 3.3. TCP messages

- 3.4. Initializing a terminal

- 3.5. Closing a terminal

- 3.6. Handling timeouts

- 3.7. Error handling

- 3.8. Transactions

- 3.9. Events and callback

- 3.10. POS XML message flow examples

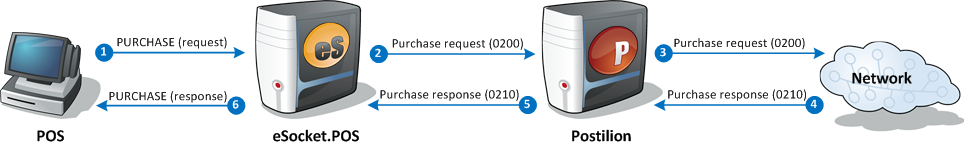

- 3.11. EFT transactions

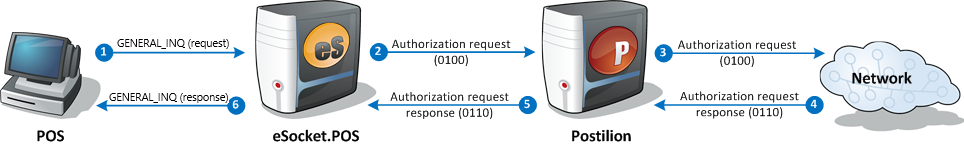

- 3.11.1. Balance inquiry

- 3.11.2. Barcode reader

- 3.11.3. Card Read Inquiry

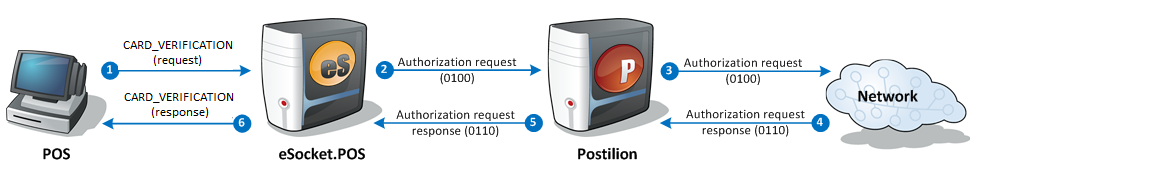

- 3.11.4. Card verification inquiry

- 3.11.5. Charitable donation amount entry

- 3.11.6. Check/Cheque verification

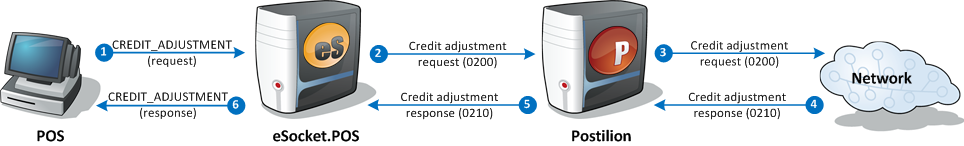

- 3.11.7. Credit adjustment

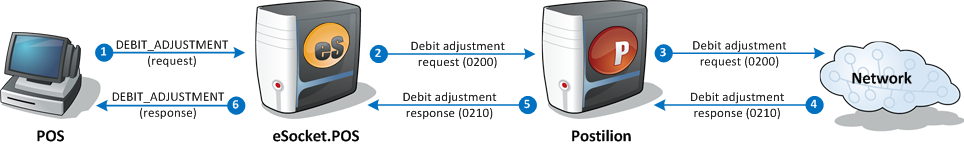

- 3.11.8. Debit adjustment

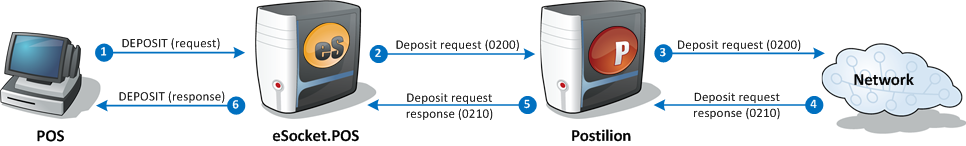

- 3.11.9. Deposit

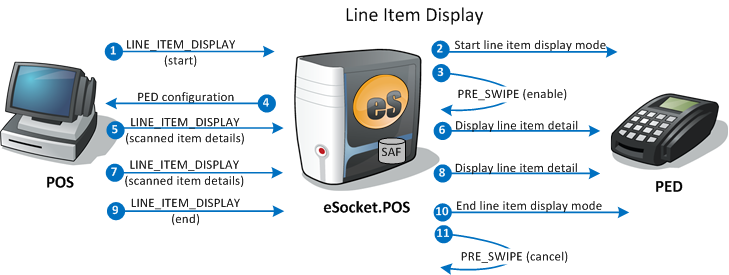

- 3.11.10. Line item display

- 3.11.11. Pay At Table initialization

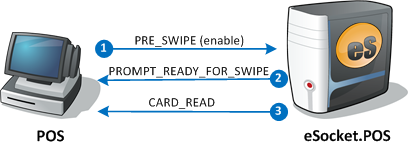

- 3.11.12. Pre-swipe

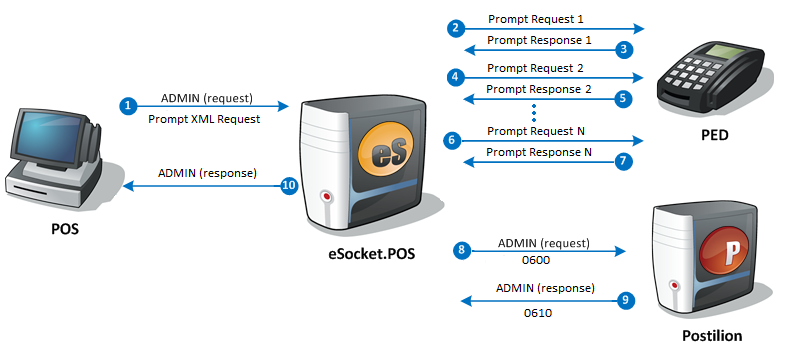

- 3.11.13. Prompt request

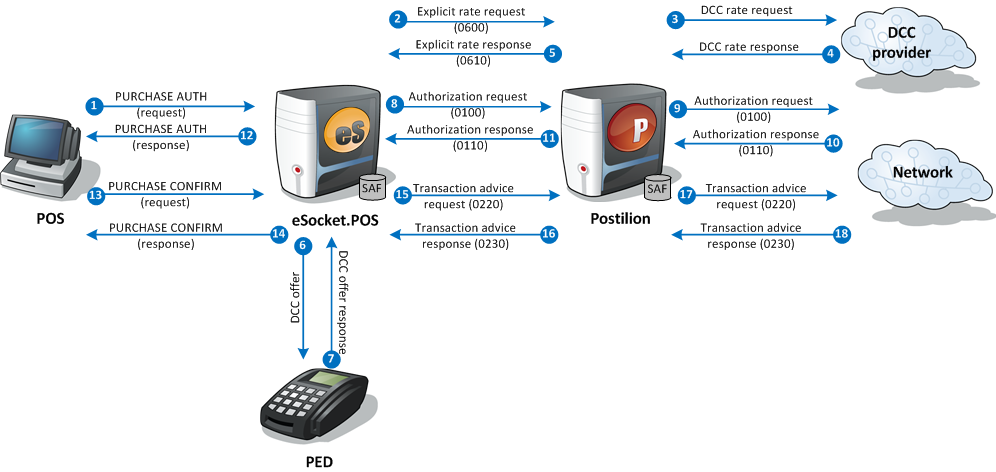

- 3.11.14. Purchase with DCC using explicit rate requests

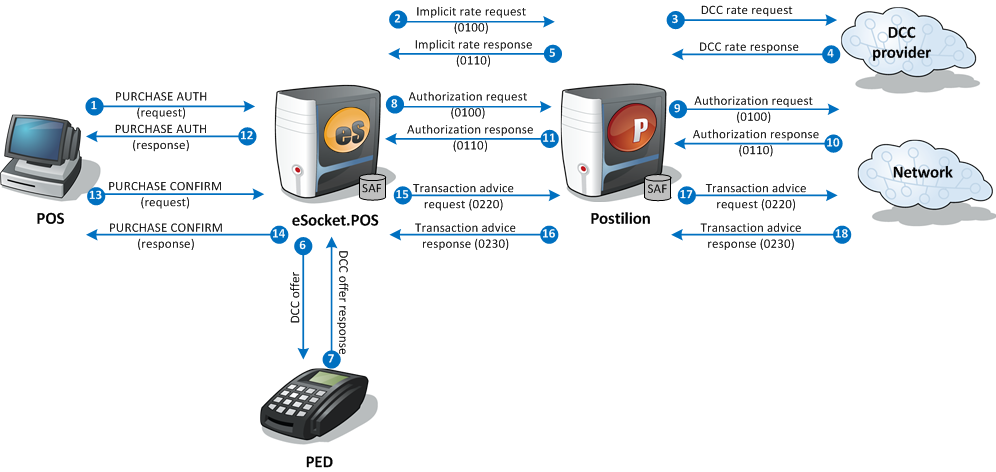

- 3.11.15. Purchase with DCC using implicit rate requests

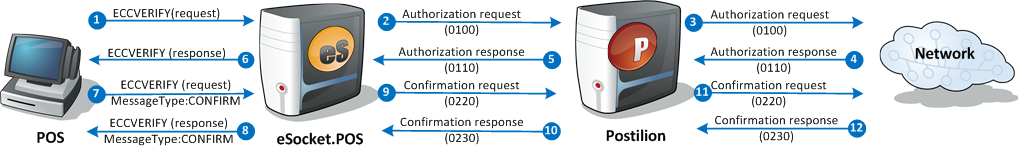

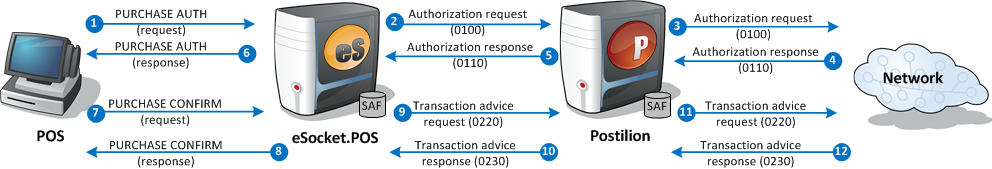

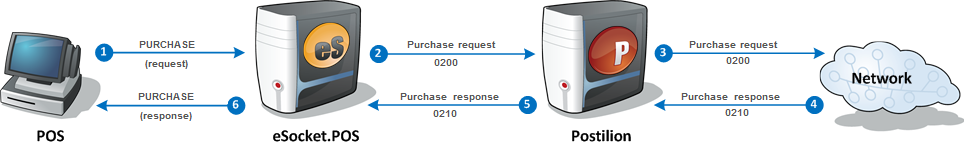

- 3.11.16. Purchase (dual message pair)

- 3.11.17. Purchase with consumer-presented QR code

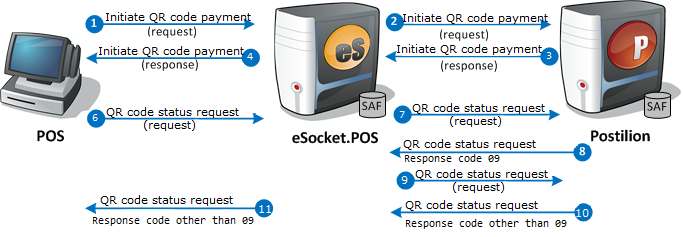

- 3.11.18. Purchase with merchant-presented QR code

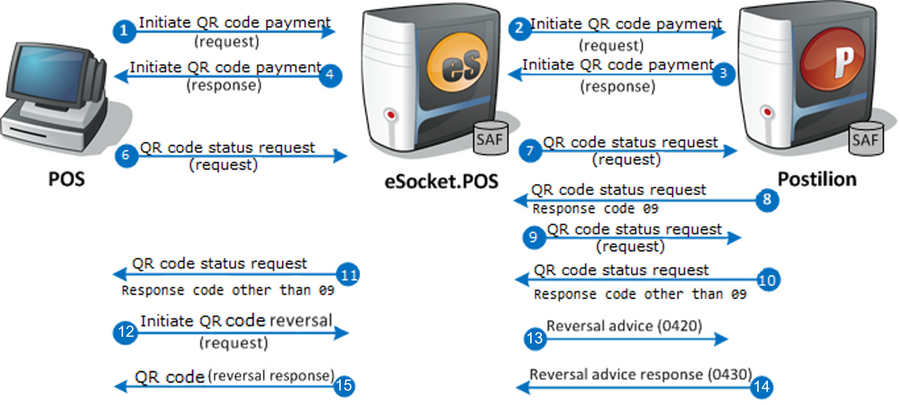

- 3.11.19. Purchase with merchant-presented QR code and reversal/void

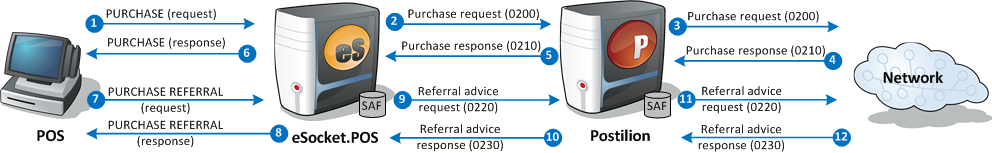

- 3.11.20. Purchase with referral

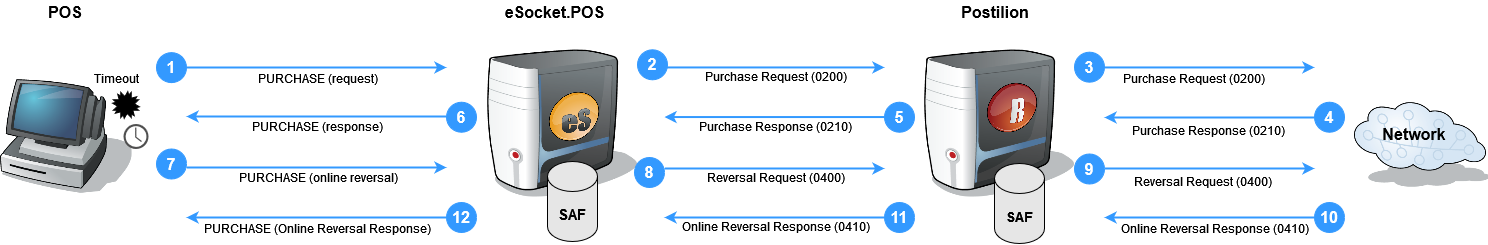

- 3.11.21. XML - Purchase with timeout and online reversal/void

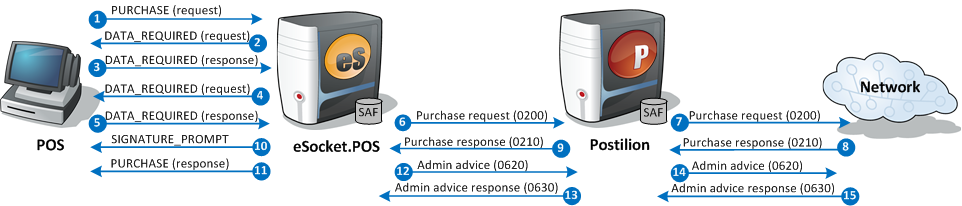

- 3.11.22. Purchase with Signature capture

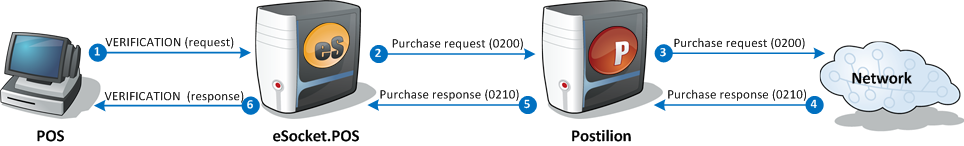

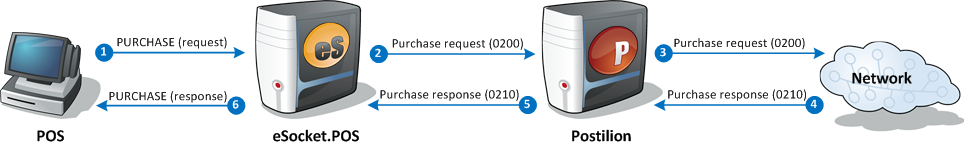

- 3.11.23. Purchase (single message pair)

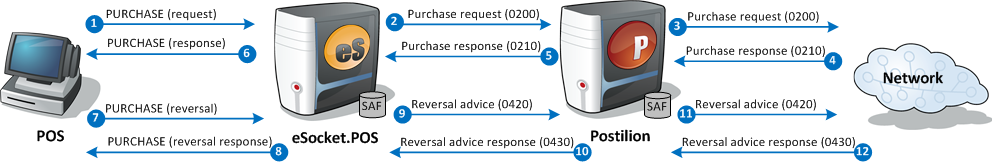

- 3.11.24. Purchase and reversal/void

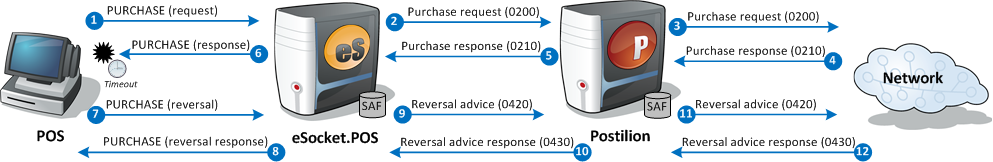

- 3.11.25. Purchase with timeout and reversal/void

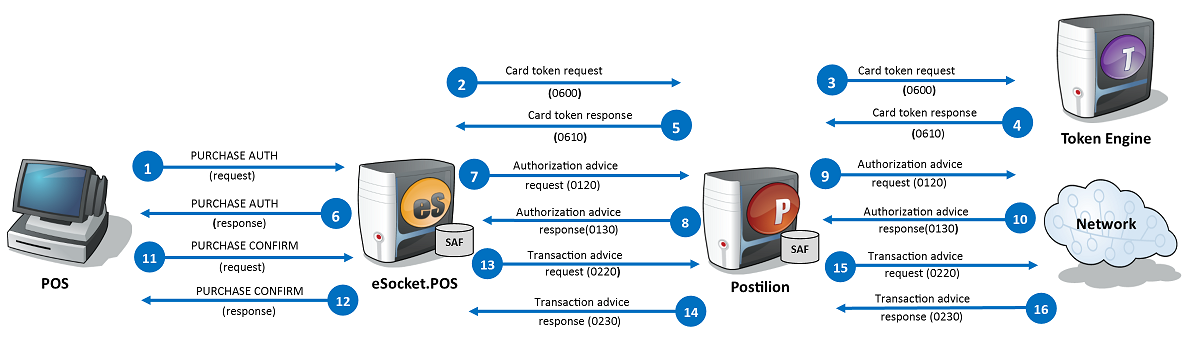

- 3.11.26. Purchase with Token generation request for online standin with advice

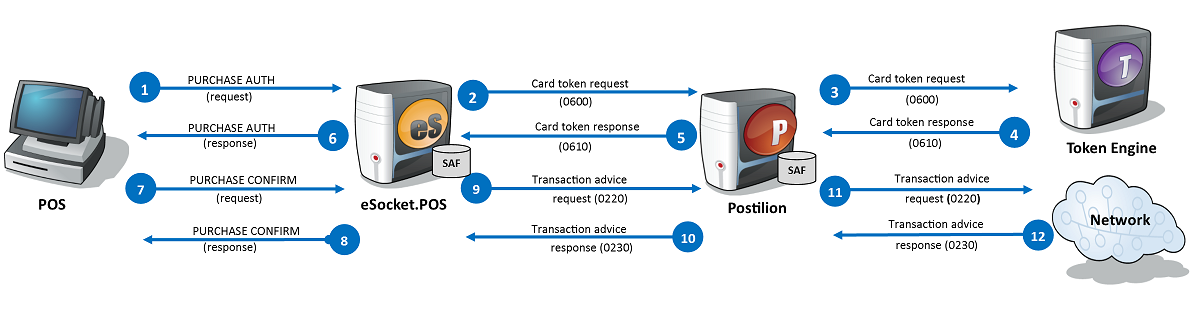

- 3.11.27. Purchase with Token generation request for online standin without advice

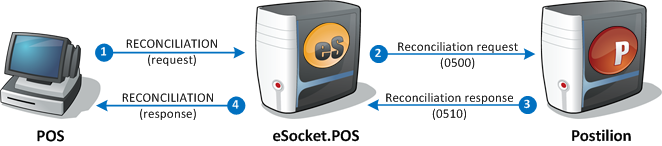

- 3.11.28. Reconciliation

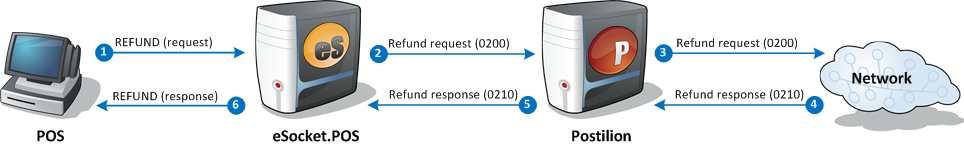

- 3.11.29. Refund

- 3.11.30. Signature capture request

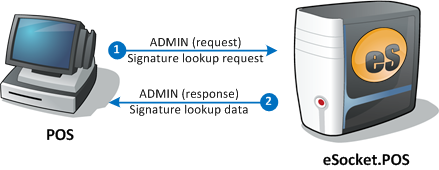

- 3.11.31. Signature lookup request

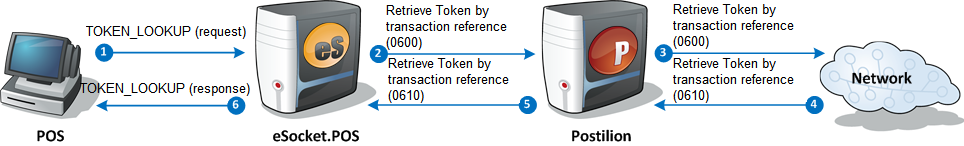

- 3.11.32. Token Lookup (TransArmor)

- 3.11.33. XML - FSA/HSA Purchase

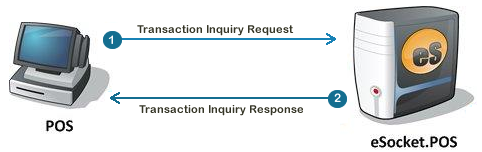

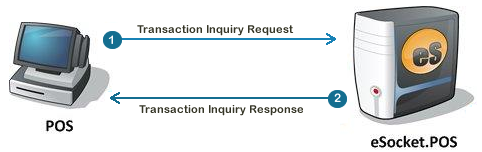

- 3.11.34. EFT Transaction Inquiry

- 3.11.35. Terminal Status

- 3.12. Gift card transactions

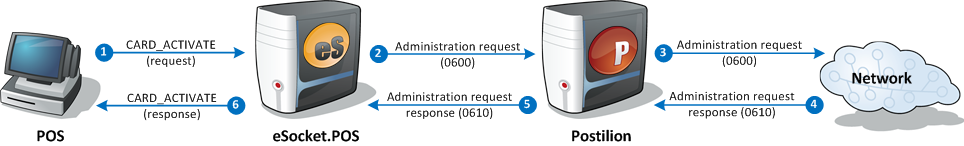

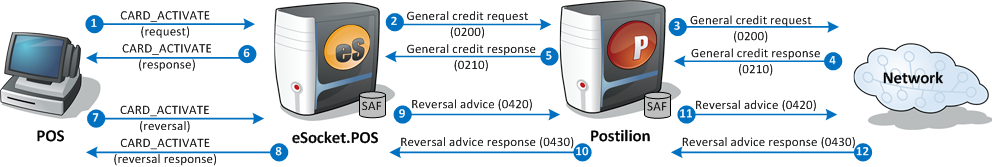

- 3.12.1. Gift card activation

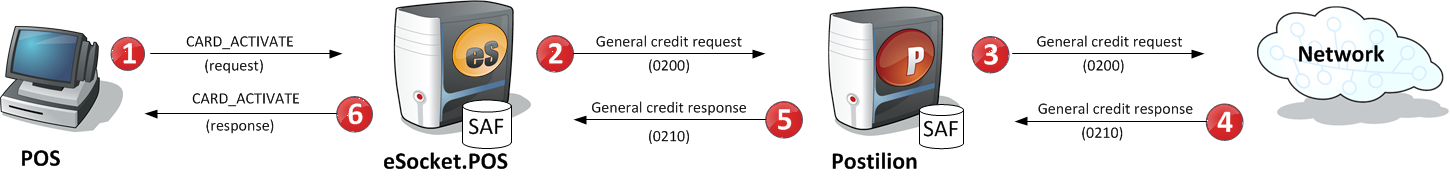

- 3.12.2. Gift card activation with load

- 3.12.3. Gift card activation with load - reversal/void

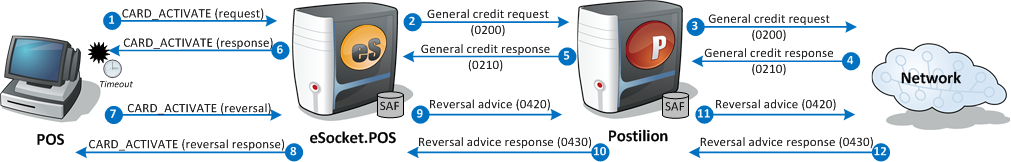

- 3.12.4. Gift card activation with load timeout

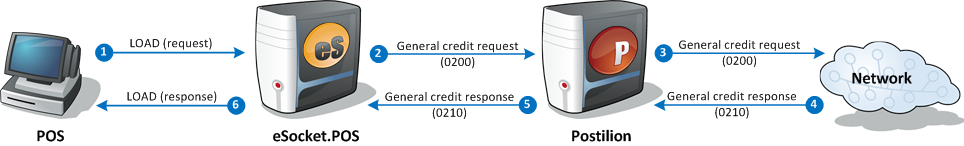

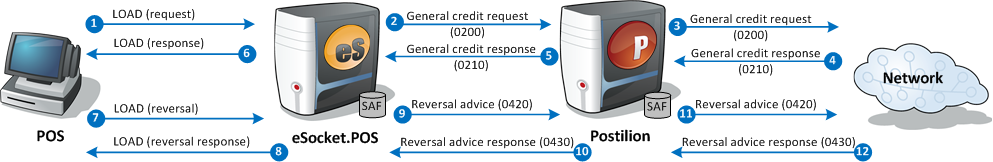

- 3.12.5. Gift card load funds

- 3.12.6. Gift card reversal/void

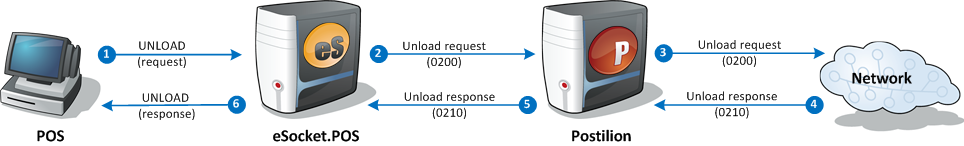

- 3.12.7. Gift card unload funds

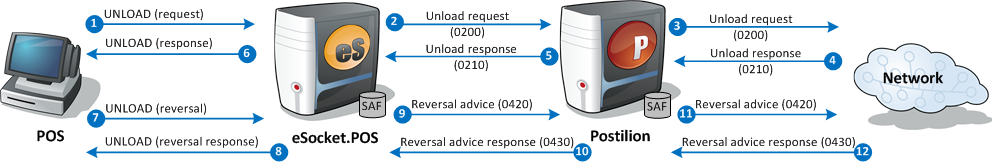

- 3.12.8. Gift card unload - reversal/void

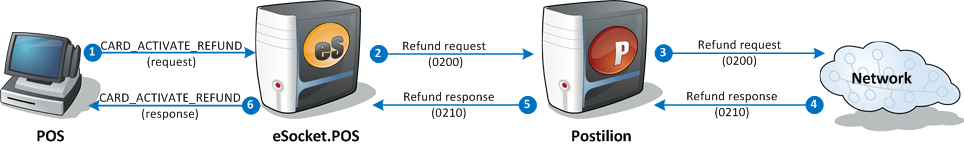

- 3.12.9. Gift card activation and refund

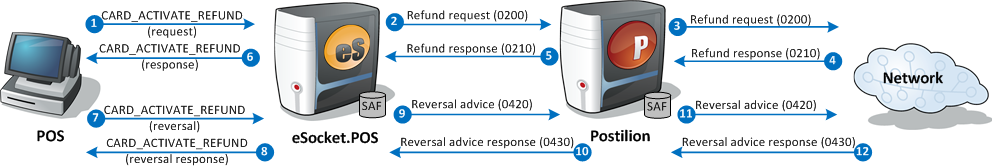

- 3.12.10. Gift card activation and refund - reversal/void

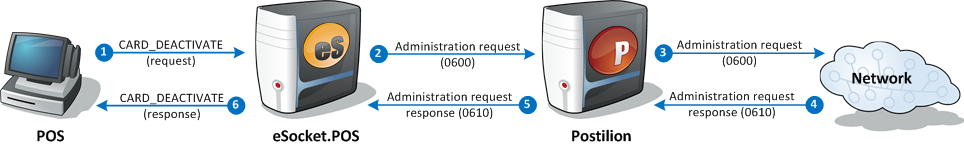

- 3.12.11. Gift card de-activation

- 3.12.12. Gift card de-activation

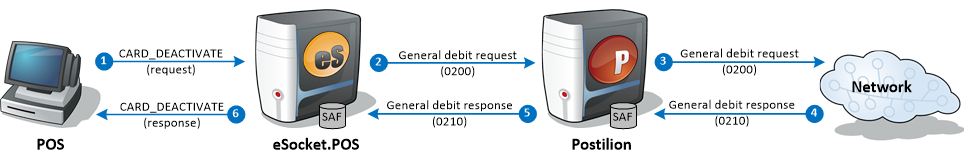

- 3.12.13. Gift card deactivation with unload

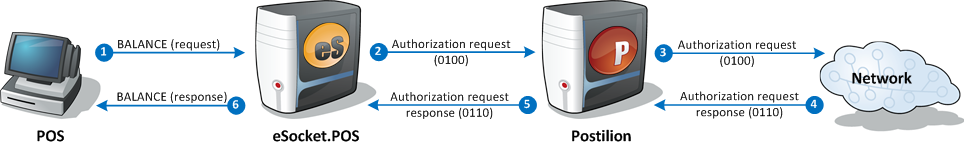

- 3.12.14. Gift card balance inquiry

- 3.12.15. Gift card Purchase - reversal/void

- 3.13. EBT transactions

- 3.14. Credit application transactions

- 3.15. Prompts

- 3.16. Display

- 3.17. Receipt printing

- 4. Implement/Extending eSocket.POS components

- 5. Object properties and conditions

- 6. Diagnostic tools

- 7. Copyright

eSocket.POS Developer Guide

Postilion ®

ACI Worldwide, Inc

2025-01-29

Version: v3.0.00.852068-r4.3

Introduction

Purpose of this document

The eSocket.POS Developer Guide serves as the primary technical reference document for developers using the eSocket.POS application programming interface (API) or the XML interface.

Intended audience

This document is intended for application developers involved in the development of POS applications using the eSocket.POS API or XML interface.

Additional information on eSocket.POS implementation, configuration, and operation can be found in the eSocket.POS User Guide.

Organization of this document

This document is organized into sections as follows:

-

Introduction

-

Interface specification

-

Java API

-

XML interface

-

Implementing/extending eSocket.POS components

-

Diagnostic tools

Related information

The following resources provide information related to the subjects discussed in this document.

Related eSocket.POS technical documents

-

eSocket.POS User Guide

Related ISO documents

The following international standards publications may also be useful.

-

ISO 3166 (1988): Codes for the Representation of Names of Countries

-

ISO 4217 (1990): Codes for the Representation of Names of Currencies and Funds

-

ISO 7813 (1995): Identification cards – Financial transaction cards

-

ISO 8583 (1987): Financial transaction card originated messages – Interchange message specifications

-

ISO/IEC 7816-5 (1994): Identification cards – Integrated circuit(s) cards with contacts – Part 5: Numbering system and registration procedure for application identifiers

Other related documents

Contacts

Please contact your primary support provider for further information or feedback.

Overview - eSocket.POS

eSocket.POS provides an application programming interface (API) and an XML message interface. These help enable rapid application development to provide EFT functionality to a Point-of-Sale (POS) system.

eSocket.POS is one of the many ways consumer transactions can be introduced into a Postilion system. Typically, this provides a multi-lane retailer with a way of interfacing their POS application with an upstream Postilion system.

Postilion is a comprehensive electronic commerce and funds transfer system. It is designed to deliver consumer transactions at every level of an EFT network. The Postilion family of products provides for custom-made electronic commerce solutions over a wide range of environments.

A more detailed introduction to the eSocket.POS application can be found in the eSocket.POS User Guide .

Protecting sensitive cardholder information

The theft of cardholder data is a major concern for all participants in the payments industry. The Payment Card Industry Security Standards Council (PCI SSC) has developed a set of requirements known as the Payment Card Industry Software Security Framework(PCI SSF).

As part of the requirements, the PCI SSF states that the sensitive cardholder data must be rendered unreadable anywhere that it is stored. This includes data on portable media, backup media, in logs, and data received from or stored by wireless networks. It is the responsibility of the POS developer to follow the standards defined by the PCI SSF to help protect sensitive card holder. For example, when it is necessary to present a PAN for purposes such as tracing, the PAN must be masked.

Additionally, the PCI SSC has defined a set of best practices called the Secure Sofware Standard (S3). This standard is aimed at assisting software vendors to create secure payment applications.

For more information, refer to the PCI web site: https://www.pcisecuritystandards.org/ .

1. Interface specification

1.1. Interface specification - Overview

This section defines the eSocket.POS interface as follows:

-

The different transactions are explained, together with instructions on how their properties should be set.

-

The different administrative methods or messages are described.

-

Descriptions of all the properties for the different transactions are detailed.

-

Events and Callback are described in general terms.

-

An overview of gift card transactions is provided.

-

The mapping between the eSocket.POS interface and the underlying ISO 8583 transaction is described.

Refer to the relevant sections for further information on the two ways in which the eSocket.POS interface can be implemented:

-

the Java API

-

the XML interface

1.2. Interface Specification - Transactions

1.2.1. EspTransaction

Transactions are performed using an EspTransaction object in the API, or an Esp:Transaction element in the XML interface. The properties should be set according to the rules set out in the following table.

(Properties that are sub-elements with their own properties are shown in bold text, while properties that are not elements appear in a normal font. See Object and Property Conditions for an explanation of the Cond and Rsp columns)

| Property | Cond | Rsp | Description | ||

|---|---|---|---|---|---|

M |

A |

||||

M |

A |

||||

M |

A |

||||

O |

C |

Can be set to indicate AUTH, REFERRAL, ADMIN_REQUEST or CONFIRM message type in requests. Value in response is set based on the request value.

|

|||

O |

- |

||||

C |

T |

Must be set to true for a reversal. The default (if this property is not set) is false . |

|||

O |

C |

Defaults to ADVICE (offline). |

|||

O |

A |

||||

O |

A |

||||

O |

A |

||||

C |

H |

This property must be set to the following values, depending on the transaction type:

|

|||

O |

H |

||||

O |

H |

||||

O |

H |

||||

O |

C |

This property can be used to identify the sequence of transactions to which this transaction is chained. This is useful in the case where the sequence identifier is common between the transactions or has a format which is not compatible with Transaction Id 's n6 format. |

|||

O |

C |

||||

O |

- |

||||

CG |

G |

If eSocket.POS does not read the card, either the Track2 or the CardNumber and ExpiryDate properties must be set. If eSocket.POS is configured to mask sensitive data, it will send the first 6 digits and the last 4 digits of this field in the clear and will mask the middle remainder of the field. For a message type of "CONFIRM": if the PAN component is configured to encrypt the PAN, this field won’t be set if eSocket.POS is restarted. For advice responses to the POS if eSocket.POS is configured with point-to-point encryption, this field won’t be set in the response. |

|||

CG |

A |

If eSocket.POS does not read the card, either the Track2 or the CardNumber and ExpiryDate properties must be set. For advice responses to the POS if eSocket.POS is configured with point-to-point encryption, this field won’t be set in the response. |

|||

C |

C |

Should be sent in a referral when an authorization number is provided, for instance after calling an authorization center. Will be present in a response if set by the authorizer of the transaction and the value is longer than the standard field (AuthorizationNumber) and up to 8 characters in length. |

|||

C |

C |

Should be sent in a referral when an authorization number is provided, for instance after calling an authorization center. Will be present in a response if set by the authorizer of the transaction and the value is longer than the standard field (AuthorizationNumber) and ExtendedAuthorizationNumber and up to 50 characters in length. |

|||

O |

G |

Will be returned if the EffectiveDate component has been configured in the response pipeline in eSocket.POS and the card configuration indicates that either effective (start) date validation is required or that an effective date is available. Note that returning the effective date is a UK requirement. |

|||

O |

T |

||||

O |

- |

||||

O |

TCG |

If the card is configured to mask sensitive data, this field will not be set in the response. If the Message Type is "CONFIRM" and eSocket.POS has been restarted, this field will not be set in the response, even if it is configured not to mask this field. |

|||

CG |

TCG |

If eSocket.POS does not read the card, either the Track2 or the CardNumber and ExpiryDate properties must be set. If eSocket.POS is configured to mask sensitive data, it will send the first 6 digits and the last 4 digits of the PAN in Track2 in the clear and will mask the middle remainder of the PAN as well as the service restriction code and discretionary data in the response. If the Message Type is "CONFIRM" and eSocket.POS has been restarted, this field will not be set in the response, even if it is configured not to mask this field. |

|||

O |

CG |

In general not returned unless eSocket.POS declines the transaction. If eSocket.POS is configured to mask sensitive data, this field will not be set in the response. |

|||

O |

A |

If not set, this value will be set based on the presence or absence of Track2 . |

|||

O |

A |

If not set, the default value of '00' - Normal Presentment will be assumed. |

|||

G |

A |

Required unless eSocket.POS inserts the amount. On a transaction with an accepted DCC offer, this will be in the source/local currency. |

|||

CG |

T |

Required for a transaction involving cashback unless the Cashback component has been configured to insert the cashback amount. |

|||

OG |

H |

Required for a transaction involving gratuity unless the Gratuity component has been configured. |

|||

O |

A |

Mandatory for some configurations where the PAN component is placed before the Amount component; the CurrencyCode might be required to allow a fallback transaction. On a transaction with an accepted DCC offer, this will be the source/local currency code. |

|||

CG |

T |

Required for a transaction involving an extended payment period unless the Extended Payment component will insert the extended payment period. |

|||

G |

A |

Required if eSocket.POS is not configured with an Account component. Optional otherwise. |

|||

O |

- |

Required if PIN entry and encryption is performed by the POS. |

|||

C |

- |

Required if PinData is present. |

|||

O |

T |

||||

- |

H |

||||

O |

G |

||||

O |

A |

||||

- |

A |

||||

O |

A |

||||

C |

C |

Should be sent in a referral when an authorization number is provided, for instance after calling an authorization center. Will be present in a response if set by the authorizer of the transaction. |

|||

- |

C |

Will be present if the authorizer of the transaction was not the card issuer. |

|||

- |

T |

||||

C |

C |

Should be sent when a token-based authentication is used by the upstream entity. |

|||

O |

T |

Will be ignored unless PostalCode property is also set. |

|||

O |

T |

||||

- |

H |

||||

O |

C |

Should be sent when the PIN was bypassed for the contactless transaction. |

|||

- |

CG |

Will be returned if Track 2 Data is available. Won’t be set in the response if eSocket.POS is configured to mask sensitive data. |

|||

- |

G |

Will be returned if this card product is configured in eSocket.POS. |

|||

- |

G |

Will be returned if set up by a response pipeline component in eSocket.POS. |

|||

- |

G |

Will be returned if set up by a response pipeline component in eSocket.POS. |

|||

- |

C |

Will be provided in a referral authorization response if a referral telephone number is available for this card. |

|||

O |

G |

May be provided in the response if set up by a pipeline component. |

|||

O |

G |

May be provided in the response if set up by a pipeline component. |

|||

- |

G |

May be provided in the response if set up by a pipeline component. |

|||

- |

G |

Will be present if the RPS component is configured and transaction is Rapid Payment Service. |

|||

- |

G |

Will be present if the FallbackIndicator component is configured. Or if it was received in the request. |

|||

- |

G |

Will be present if provided by the FallbackIndicator component. Or if it was received in the xml request. |

|||

O |

C |

Will be provided in the response if available when an EMV card was used. Or if it was received in the Esp:Transaction request or as part of the TlvIccDataExtended structured data tag. EMV Tag ID: 9F02 NOTE: In the request, EmvAmount and EmvAmountAuthorized are the same. |

|||

O |

C |

Will be provided in the response if available when an EMV card was used and a cashback amount was requested. Or if it was received in the Esp:Transaction request or as part of the TlvIccDataExtended structured data tag EMV Tag ID: 9F03 |

|||

O |

C |

Will be provided in the response if available when an EMV card was used and a cashback amount was requested. Or if it was received in the Esp:Transaction request or as part of the TlvIccDataExtended structured data tag EMV Tag ID: 9F02. NOTE: In the response, if this field does not exist, it will be set to EmvAmount. |

|||

O |

C |

Will be provided in the response if available when an EMV card was used. Or if it was received in the Esp:Transaction request or as part of the TlvIccDataExtended structured data tag EMV Tag ID: 4F |

|||

O |

C |

Will be provided in the response if available when an EMV card was used. Or if it was received in the Esp:Transaction request or as part of the TlvIccDataExtended structured data tag EMV Tag ID: 82 |

|||

O |

C |

Will be provided in the response if available when an EMV card was used. Or if it was received in the Esp:Transaction request or as part of the TlvIccDataExtended structured data tag EMV Tag ID: 50 |

|||

O |

C |

Will be provided in the response if available when an EMV card was used. Or if it was received in the Esp:Transaction request or as part of the TlvIccDataExtended structured data tag This field will only be supplied in the xml interface if all characters can be represented as ASCII. EMV Tag ID: 9F12 NOTE: This field has been deprecated - please use either EmvApplicationPreferredNameRaw or EmvApplicationPreferredNameInternational. |

|||

O |

C |

Will be provided in the response if available when an EMV card was used. Or if it was received in the Esp:Transaction request or as part of the TlvIccDataExtended structured data tag EMV Tag ID: 9F12 |

|||

- |

C |

Will be provided in the response if available when an EMV card was used. Or if it was received in the Esp:Transaction request or as part of the TlvIccDataExtended structured data tag. This field will only be provided if the Java Virtual Machine (JVM) in which eSocket.POS is running supports conversion from ISO/IEC 8859 using the code page specified by the EmvIssuerCodeTableIndexEmvIssuerCodeTableIndex. EMV Tag ID: 9F12 |

|||

O |

C |

Will be provided in the response if available when an EMV card was used. Or if it was received in the Esp:Transaction request or as part of the TlvIccDataExtended structured data tag EMV Tag ID: 9F36 |

|||

O |

C |

Will be provided in the response if available when an EMV card was used. Or if it was received in the Esp:Transaction request or as part of the TlvIccDataExtended structured data tag EMV Tag ID: 9F07 |

|||

O |

C |

Will be provided in the response if available when an EMV card was used. Or if it was received in the Esp:Transaction request or as part of the TlvIccDataExtended structured data tag EMV Tag ID: 9F08 |

|||

O |

C |

Will be provided in the response if available when an EMV card was used. Or if it was received in the Esp:Transaction request or as part of the TlvIccDataExtended structured data tag EMV Tag ID: 8A |

|||

O |

C |

Will be provided in the response if available when an EMV card was used. Or if it was received in the Esp:Transaction request or as part of the TlvIccDataExtended structured data tag EMV Tag ID: 5F34 |

|||

O |

C |

Will be provided in the response if available when an EMV card was used. Or if it was received in the Esp:Transaction request or as part of the TlvIccDataExtended structured data tag EMV Tag ID: 9F26 |

|||

O |

C |

Will be provided in the response if available when an EMV card was used. Or if it was received in the Esp:Transaction request or as part of the TlvIccDataExtended structured data tag EMV Tag ID: 9F27 |

|||

O |

C |

Will be provided in the response if available when an EMV card was used. Or if it was received in the Esp:Transaction request or as part of the TlvIccDataExtended structured data tag EMV Tag ID: 8E |

|||

O |

C |

Will be provided in the response if available when an EMV card was used. Or if it was received in the Esp:Transaction request or as part of the TlvIccDataExtended structured data tag EMV Tag ID: 9F34 |

|||

O |

C |

Will be provided in the response if available when an EMV card was used. Or if it was received in the Esp:Transaction request or as part of the TlvIccDataExtended structured data tag EMV Tag ID: 9F1E |

|||

O |

C |

Will be provided in the response if available when an EMV card was used. Or if it was received in the Esp:Transaction request or as part of the TlvIccDataExtended structured data tag EMV Tag ID: 9F0D |

|||

O |

C |

Will be provided in the response if available when an EMV card was used. Or if it was received in the Esp:Transaction request or as part of the TlvIccDataExtended structured data tag EMV Tag ID: 9F0E |

|||

O |

C |

Will be provided in the response if available when an EMV card was used. Or if it was received in the Esp:Transaction request or as part of the TlvIccDataExtended structured data tag EMV Tag ID: 9F0F |

|||

O |

C |

Will be provided in the response if available when an EMV card was used. Or if it was received in the Esp:Transaction request or as part of the TlvIccDataExtended structured data tag EMV Tag ID: 9F10 |

|||

O |

C |

Will be provided in the response if available when an EMV card was used. Or if it was received in the Esp:Transaction request or as part of the TlvIccDataExtended structured data tag EMV Tag ID: 9F11 |

|||

O |

C |

Will be provided in the response if available when an EMV card was used. |

|||

- |

C |

Will be provided in the response if available when an EMV card was used. |

|||

- |

C |

Will be provided in the response if available when an EMV card was used. |

|||

- |

C |

Will be provided in the response if available when an EMV card was used. Or if it was received in the Esp:Transaction request or as part of the TlvIccDataExtended structured data tag |

|||

O |

C |

Will be provided in the response if available when an EMV card was used. Or if it was received in the Esp:Transaction request or as part of the TlvIccDataExtended structured data tag EMV Tag ID: 9F09 |

|||

O |

C |

Will be provided in the response if available when an EMV card was used. Or if it was received in the Esp:Transaction request or as part of the TlvIccDataExtended structured data tag EMV Tag ID: 9F33 |

|||

O |

C |

Will be provided in the response if available when an EMV card was used. Or if it was received in the Esp:Transaction request or as part of the TlvIccDataExtended structured data tag EMV Tag ID: 9F1A |

|||

O |

C |

Will be provided in the response if available when an EMV card was used. Or if it was received in the Esp:Transaction request or as part of the TlvIccDataExtended structured data tag EMV Tag ID: 9F66 |

|||

O |

C |

Will be provided in the response if available when an EMV card was used. Or if it was received in the Esp:Transaction request or as part of the TlvIccDataExtended structured data tag EMV Tag ID: 9F35 |

|||

O |

C |

Will be provided in the response if available when an EMV card was used. Or if it was received in the Esp:Transaction request or as part of the TlvIccDataExtended structured data tag EMV Tag ID: 95 |

|||

O |

C |

Will be provided in the response if available when an EMV card was used. Or if it was received in the Esp:Transaction request or as part of the TlvIccDataExtended structured data tag EMV Tag ID: 9F53 |

|||

O |

C |

Will be provided in the response if available when an EMV card was used. Or if it was received in the Esp:Transaction request or as part of the TlvIccDataExtended structured data tag EMV Tag ID: 5F2A |

|||

O |

C |

Will be provided in the response if available when an EMV card was used. Or if it was received in the Esp:Transaction request or as part of the TlvIccDataExtended structured data tag EMV Tag ID: 9A |

|||

O |

C |

Will be provided in the response if available when an EMV card was used. Or if it was received in the Esp:Transaction request or as part of the TlvIccDataExtended structured data tag EMV Tag ID: 9F41 |

|||

O |

C |

Will be provided in the response if available when an EMV card was used. Or if it was received in the Esp:Transaction request or as part of the TlvIccDataExtended structured data tag EMV Tag ID: 9B |

|||

O |

C |

Will be provided in the response if available when an EMV card was used. Or if it was received in the Esp:Transaction request or as part of the TlvIccDataExtended structured data tag EMV Tag ID: 9C |

|||

O |

C |

Will be provided in the response if available when an EMV card was used. Or if it was received in the Esp:Transaction request or as part of the TlvIccDataExtended structured data tag EMV Tag ID: 9F37 |

|||

O |

C |

Will be provided in the response if available when an EMV card was used. Or if it was received in the Esp:Transaction request or as part of the TlvIccDataExtended structured data tag EMV Tag ID: 9F6E |

|||

O |

C |

Will be provided in the response if available when an EMV card was used. Or if it was received in the Esp:Transaction request or as part of the TlvIccDataExtended structured data tag EMV Tag ID: 9F7C |

|||

- |

C |

Will be provided in the response if available when an EMV card was used. Or if it was received in the Esp:Transaction request or as part of the TlvIccDataExtended structured data tag EMV Tag ID: 9F40 |

|||

- |

C |

Will be provided in the response if available when an EMV card was used. Or if it was received in the Esp:Transaction request or as part of the TlvIccDataExtended structured data tag EMV Tag ID: 9F21 |

|||

- |

C |

Will be provided in the response if available when an EMV card was used. Or if it was received in the Esp:Transaction request or as part of the TlvIccDataExtended structured data tag EMV Tag ID: 87 |

|||

- |

C |

Will be provided in the response if available when an EMV card was used. Or if it was received in the Esp:Transaction request or as part of the TlvIccDataExtended structured data tag EMV Tag ID: 5F28 |

|||

- |

C |

Will be provided in the response if available when an EMV card was used. Or if it was received in the Esp:Transaction request or as part of the TlvIccDataExtended structured data tag EMV Tag ID: 5F24 |

|||

- |

C |

Will be provided in the response if it was returned by the upstream entity after online issuer authentication. EMV Tag ID: 91 |

|||

- |

C |

Will be provided in the response if it was returned by the upstream entity after online issuer authentication. EMV Tag ID: 71 |

|||

- |

C |

Will be provided in the response if it was returned by the upstream entity after online issuer authentication. EMV Tag ID: 72 |

|||

- |

C |

Will be provided in the response if the transaction involved a charitable donation with a digital charitable donation provider for calculating the charity amount, or if the customer selected/entered a donation amount on the PED during a CHARITABLE_DONATION_AMOUNT_ENTRY transaction. |

|||

O |

- |

The text to display on the PED when prompting the customer to select or enter a charitable donation amount on the PED during a CHARITABLE_DONATION_AMOUNT_ENTRY transaction. If not provided, the text configured for the device driver will be displayed by default. |

|||

O |

- |

A list of one or more donation amount options to display on the PED when prompting the customer to select or enter a charitable donation amount on the PED during a CHARITABLE_DONATION_AMOUNT_ENTRY transaction. If not provided, the customer will be prompted to manually enter the amount instead, if allowed by the CharitableDonation pipeline component configuration. |

|||

C |

- |

Specifies the text and value to use for a particular charitable donation amount option. |

|||

- |

C |

Will be provided in the response if the transaction involved a charitable donation with a digital charitable donation provider for calculating the charity amount. |

|||

- |

C |

Will be provided in the response if the transaction involved a charitable donation with a digital charitable donation provider for calculating the charity amount. |

|||

- |

C |

Will be provided in the response if the transaction involved a charitable donation with a digital charitable donation provider for calculating the charity amount. |

|||

- |

C |

Will be provided in the response if the transaction involved a charitable donation with a digital charitable donation provider for calculating the charity amount. |

|||

- |

C |

Will be provided in the response if the transaction involved a charitable donation with a digital charitable donation provider for calculating the charity amount. |

|||

O |

HG |

||||

- Name |

M |

A |

|||

- Value |

M |

A |

|||

- Flags |

O |

G |

|||

- - DoNotPersist |

O |

G |

|||

O |

HG |

||||

- Name |

M |

A |

|||

- Value |

M |

A |

|||

O |

G |

May be set in order to send level 2 and 3 details for a transaction involving a purchasing card. Within this element, all attributes are optional. NOTE: At this time only the PurchasingCardData.InvoiceNumber field is returned in the response. |

|||

- |

H |

||||

- |

H |

||||

- |

H |

||||

- |

H |

||||

- Sign |

- |

H |

|||

- Amount |

- |

H |

|||

- |

H |

||||

- DateTime |

O |

H |

|||

- |

H |

||||

- |

H |

||||

- |

H |

||||

- |

H |

||||

- |

H |

||||

- |

H |

||||

- |

H |

||||

O |

C |

||||

O |

- |

Aimed at P2PE scenarios where the device/PED implements a P2PE scheme supported by ACI, yet eSocket.POS does not drive the device/PED (e.g., fuel forecourts). |

|||

- Scheme |

M |

- |

This subfield is only mandatory if the PanReference field is present. |

||

- Ksn |

O |

- |

|||

- Data |

O |

- |

|||

O |

- |

||||

O |

- |

||||

O |

- |

||||

O |

- |

||||

O |

C |

Will be provided in the response if the chained transaction information could be retrieved. |

|||

M |

- |

Indicates which set of logical devices will be used. |

|||

O |

C |

Stand alone dynamic text that will be displayed on the screens that host the check box prompts. |

|||

O |

C |

Indicates whether or not the image should be included in the transaction response. |

|||

O |

C |

The format of the image to be returned in the response, if requested in the SignatureImagePassedInResponse field. |

|||

O |

C |

This field will be used to populate the scrollable text area on the free text screens. |

|||

O |

C |

The sequence number to associate with the image. If more than one image is associated with a single transaction, this value will differentiate between them. Only to be set for a signature capture transaction. |

|||

O |

C |

The format of the image in the user interface request. Only to be set for a signature capture transaction. |

|||

O |

C |

The category of the image. Only to be set for a signature capture transaction. |

|||

O |

C |

Indicates whether the image in the user interface message request is encrypted. Only to be set for a signature capture transaction. |

|||

O |

C |

Dynamic text label associated with the first check box on forms. |

|||

O |

C |

Dynamic text label associated with the second check box on forms. |

|||

O |

C |

Dynamic text label associated with the third check box on forms. |

|||

O |

C |

The state of the first check box after user input. |

|||

O |

C |

The state of the second check box after user input. |

|||

O |

C |

The state of the third check box after user input. |

|||

O |

C |

Indicates the button input collected from the user. |

|||

O |

C |

The name of the prompt. Only to be set for a signature capture transaction. |

|||

O |

C |

The full response text as sent by the EBT provider. |

|||

O |

C |

The beginning food stamp account balance. |

|||

O |

C |

The ending food stamp account balance. |

|||

O |

C |

The available food stamp account balance. |

|||

O |

C |

The beginning cash benefits account balance. |

|||

O |

C |

The ending cash benefits account balance. |

|||

O |

C |

The available cash benefits account balance. |

|||

O |

C |

EBT case number. |

|||

O |

C |

EBT voucher number. |

|||

C |

C |

The total amount for the healthcare transaction . If extended transaction type is set to "7111 - Healthcare Benefit", then this field should be set. |

|||

O |

- |

The amount for the prescription component of the healthcare transaction. |

|||

O |

- |

The amount for the optical component of the healthcare transaction. |

|||

O |

- |

The amount for the dental component of the healthcare transaction. |

|||

O |

- |

The amount for the clinic component of the healthcare transaction. |

|||

O |

T |

Lodging (e.g., hotel, motel) transactions: The lodging facility’s internal invoice or billing identification reference number. |

|||

O |

T |

Lodging (e.g., hotel, motel) transactions: The local phone number of the lodging facility at which the cardholder stayed. |

|||

O |

T |

Lodging (e.g., hotel, motel) transactions: The date on which the cardholder checked in at the lodging facility. |

|||

O |

T |

Lodging (e.g., hotel, motel) transactions: The date on which the cardholder checked out of the lodging facility. |

|||

O |

T |

Lodging (e.g., hotel, motel) transactions: The daily room charges, exclusive of taxes and fees. |

|||

O |

T |

Lodging (e.g., hotel, motel) transactions: The daily room tax amount. |

|||

O |

T |

Lodging (e.g., hotel, motel) transactions: The total amount of phone calls charged to the room. |

|||

O |

T |

Lodging (e.g., hotel, motel) transactions: The total amount of restaurant and/or room service food charged to the room. |

|||

O |

T |

Lodging (e.g., hotel, motel) transactions: The total amount of bar and in-room "mini-bar" items charged to the room. |

|||

O |

T |

Lodging (e.g., hotel, motel) transactions: The total amount of laundry and drycleaning items charged to the room. |

|||

O |

T |

Lodging (e.g., hotel, motel) transactions: The total amount of gift shop and specialty shop items charged to the room. |

|||

O |

T |

Lodging (e.g., hotel, motel) transactions: The total amount of miscellaneous items/services charged to the room, not specified elsewhere. |

|||

O |

T |

Lodging (e.g., hotel, motel) transactions: Indicates the type of charges provided in LdAmountOtherServices. |

|||

O |

T |

Lodging (e.g., hotel, motel) transactions: The amount of any additional charges incurred after the cardholder’s departure. |

|||

O |

T |

Lodging (e.g., hotel, motel) transactions: A code allocated by the acquirer that identifies special circumstances. |

|||

O |

T |

Lodging (e.g., hotel, motel) transactions: The customer service number that the cardholder may call to resolve questions or disputes. |

|||

O |

T |

Lodging (e.g., hotel, motel) transactions: The number of guests. |

|||

O |

T |

Lodging (e.g., hotel, motel) transactions: The name of the guest. |

|||

O |

A |

||||

- |

C |

The Visa Available Offline Spending Amount value, if available on the card. |

|||

O |

- |

The Alternative Payment Method. |

|||

O |

- |

The Payment Brand. |

|||

O |

- |

The QR code data in QR code transactions (e.g., a URL, identification number or transactional data string). This field takes precedence over the BarcodeData field in request messages. |

|||

O |

- |

An additional transaction reference received from the host system in QR code transaction response messages. |

|||

O |

- |

The QR code image encoded in Base64. |

|||

O |

- |

The QR code transaction ID received from the host system. This field should be set in refund requests for consumer-presented QR code transactions, if required. It should also be sent in merchant-presented QR code transaction status requests. |

|||

O |

- |

The QR code type in the QR code transactions. |

|||

O |

- |

The barcode data. e.g., 0123456789. This field will be ignored in request messages if the QRCodeData field is set. |

|||

O |

- |

Can be set to indicate the quantity of items purchased in consumer-presented QR code transaction requests. |

|||

O |

- |

Can be set to indicate the name of the Transaction in consumer-presented QR code transaction requests. |

|||

O |

- |

Can be set to indicate the store ID in consumer-presented QR code transaction requests. |

|||

O |

- |

Can be set to indicate the memo in consumer-presented QR code transaction requests. |

|||

- |

C |

The dynamic currency conversion (DCC) status code. |

|||

- |

C |

An identifier for the external entity that provided the currency conversion information which represents a DCC offer. |

|||

- |

C |

The exchange rate used when performing currency conversion from the amount in the source currency to the amount in the target currency. |

|||

- |

C |

Numeric code of the currency being converted from. |

|||

- |

C |

Alphabetic code of the currency being converted from. |

|||

- |

C |

The number of digits following the decimal separator. |

|||

- |

C |

Numeric code of the currency being converted to. |

|||

- |

C |

Alphabetic code of the currency being converted to. |

|||

- |

C |

The number of digits following the decimal separator. |

|||

- |

C |

The currency conversion service provider. |

|||

- |

C |

The source of conversion data. |

|||

- |

C |

Time the conversion was performed in Coordinated Universal Time (UTC). |

|||

- |

C |

Numeric value representing the foreign exchange markup rate as a fraction. |

|||

- |

C |

Numeric value representing the foreign exchange commission rate as a fraction. |

|||

- |

C |

Numeric value representing the foreign exchange markup, it compare the DCC exchange rate to the European Central Bank rate as a fraction. |

|||

- |

C |

Amount of the transaction in the currency being converted from. |

|||

- |

C |

Amount of the transaction in the currency being converted to. |

|||

- |

C |

The offer expiration date and time in Coordinated Universal Time (UTC). |

|||

- |

C |

Additional disclaimer information required for printing on receipts. |

|||

- |

C |

Additional disclaimer information required for printing on receipts. |

|||

- |

C |

The dynamic currency conversion specific acquirer identifier. |

|||

- |

C |

The dynamic currency conversion specific card acceptor identifier. |

|||

- |

C |

The dynamic currency conversion specific terminal identifier. |

|||

- |

H |

The Credit or Debit network that processed the transaction. |

|||

O |

H |

Payee name and address contains identification and billing information for a payee. |

|||

O |

H |

Contains additional payee name and address details. |

|||

O |

H |

Contains account details needed for a credit application. |

|||

O |

H |

The status response from ADS based on the processor specification. |

|||

O |

H |

The status response that contains information about the account. |

|||

G |

T |

Indicates whether the merchant or cardholder OPC selection mode should be applied. |

|||

O |

T |

Indicates whether the amount requested is a pre-authorization, normal authorization or the final amount. |

|||

G |

G |

Contains additional card details, as configured in eSocket.POS. |

|||

G |

- |

Can be set to send details for a transaction involving a fleet card. Within this element, all attributes are optional. |

|||

- |

H |

Set in response to send details to the pump from the acquirer for a transaction involving a fleet card. Within this element, all attributes are optional. |

|||

O |

H |

An optional PosGeographicDataLatitude field can be attached to a transaction. |

|||

O |

H |

An optional PosGeographicDataLongitude field can be attached to a transaction. |

|||

O |

H |

An optional TerminalAddress field can be attached to a transaction. |

|||

O |

- |

Set to disable the welcome and transaction outcome displays on a device. |

|||

O |

H |

Specifies the recurring payment indicator. |

|||

O |

H |

Specifies the stored credential indicator. |

|||

O |

H |

Contains the detail of the recurring payment. |

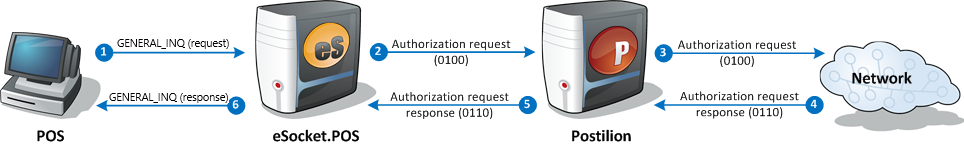

1.2.2. EspInquiry

Inquiries are performed using an EspInquiry object in the API, or an Esp:Inquiry element in the XML interface. The properties should be set according to the rules set out in the following table.

(Properties that are sub-elements with their own properties are shown in bold text, while properties that are not elements appear in a normal font. See Object and Property Conditions for an explanation of the Cond and Rsp columns)

| Property | Cond | Rsp | Description |

|---|---|---|---|

M |

A |

||

M |

A |

||

M |

A |

||

O |

A |

||

O |

A |

||

O |

A |

||

O |

H |

For an account inquiry for a credit admin status application transaction received from the POS, set this property to '7007'. For a customer linked account inquiry for a credit account lookup transaction received from the POS, set this property to '7001'. |

|

O |

H |

||

C |

C |

Should be sent in a referral when an authorization number is provided, for instance after calling an authorization center. Will be present in a response if set by the authorizer of the transaction. |

|

C |

C |

Should be sent when a token-based authentication is used by the upstream entity. |

|

O |

T |

Will be ignored unless PostalCode property is also set. |

|

O |

C |

Should be sent when the PIN was bypassed for the contactless transaction. |

|

O |

T |

||

O |

H |

||

O |

H |

||

O |

C |

||

O |

C |

||

O |

- |

||

CG |

TG |

If eSocket.POS does not read the card, either the Track2 or the CardNumber and ExpiryDate properties must be set. In a check verification or check guarantee transaction, the card number should be set to 19 zeros if no check/cheque card is to be used. If eSocket.POS is configured to mask sensitive data, eSocket.POS will send the first 6 digits and the last 4 digits of this field in the clear and will mask the middle remainder of the field. |

|

CG |

T |

If eSocket.POS does not read the card, either the Track2 or the CardNumber and ExpiryDate properties must be set. |

|

C |

C |

Should be sent in a referral when an authorization number is provided, for instance after calling an authorization center. Will be present in a response if set by the authorizer of the transaction and the value is longer than the standard field (AuthorizationNumber) and up to 8 characters in length. |

|

O |

T |

||

O |

- |

||

O |

- |

Used for transaction inquiries to provide the MessageType of the original transaction that should be retrieved. |

|

O |

- |

Used for transaction inquiries to provide the Type of the original transaction that should be retrieved. |

|

O |

C |

Will be returned in the response of a transaction inquiry with the transaction data if the transaction is found |

|

O |

CG |

Will be returned if this inquiry type was CARD_READ and the data for this track is available. If the card is configured to mask sensitive data, this field won’t be set in the response. |

|

CG |

TG |

If eSocket.POS does not read the card, either the Track2 or the CardNumber and ExpiryDate properties must be set. If eSocket.POS is configured to mask sensitive data, it will send the first 6 digits and the last 4 digits of the PAN in track2 in the clear and will mask the middle remainder of the PAN as well as the service restriction code and discretionary data in the response. |

|

O |

CG |

Will be returned if this inquiry type was CARD_READ and the data for this track is available. If eSocket.POS is configured to mask sensitive data, this field won’t be set in the response. |

|

O |

A |

May be set if the CardNumber is set. Should not be set otherwise. If not set, this value will be set by the PAN component based on the presence or absence of Track2 . |

|

O |

A |

If not set, the default value of '00' - Normal Presentment will be assumed. |

|

O |

T |

||

- |

H |

||

O |

G |

||

O |

A |

||

- |

A |

||

- |

A |

||

O |

A |

Must be set if eSocket.POS is not configured with an Account component. Optional otherwise. |

|

O |

- |

Required if PIN entry and encryption is performed by the POS |

|

C |

- |

Required if PIN data is present |

|

C |

T |

May be required in check verification or check guarantee requests. |

|

- |

C |

Will be returned if Track 2 Data is available. |

|

- |

G |

Will be returned if this card product was configured in eSocket.POS. |

|

- |

G |

Will be returned if set up by a response pipeline component in eSocket.POS. |

|

- |

G |

Will be returned if set up by a response pipeline component in eSocket.POS. |

|

O |

G |

This property is deprecated. Rather use an EspCheck object for a check verification or check guarantee transaction. |

|

O |

G |

This property is deprecated. Rather use an EspCheck object for a check verification or check guarantee transaction. |

|

O |

G |

This property is deprecated. Rather use an EspCheck object for a check verification or check guarantee transaction. |

|

- |

C |

Will be present in the response to a Balance Inquiry, an Available Funds Inquiry or else a Mini-statement Inquiry. |

|

- |

C |

Will be present in the response to a Balance or Available Funds Inquiry. May be present in a Mini-statement Inquiry. |

|

- |

C |

Will be present in the response to a Balance or Available Funds Inquiry. |

|

- |

C |

Will be present in the response to a Balance or Available Funds Inquiry. May be present in a Mini-statement Inquiry. |

|

- Sign |

- |

C |

Will be present in the response to a Balance or Available Funds Inquiry. |

- Amount |

- |

C |

Will be present in the response to a Balance or Available Funds Inquiry. May be present in a Mini-statement Inquiry. |

- |

H |

May be present in a Mini-statement Inquiry. |

|

- DateTime |

O |

H |

May be present in a Mini-statement Inquiry. Also used to filter transactions for a transaction inquiry |

- |

H |

May be present in a Mini-statement Inquiry. |

|

- |

H |

May be present in a Mini-statement Inquiry. |

|

- |

H |

May be present in a Mini-statement Inquiry. |

|

- |

H |

May be present in a Mini-statement Inquiry. |

|

- |

H |

May be present in a Mini-statement Inquiry. |

|

- |

H |

May be present in a Mini-statement Inquiry. |

|

- |

H |

May be present in a Mini-statement Inquiry. |

|

O |

G |

May be set in order to send level 2 and 3 details for a transaction involving a purchasing card. Within this element, all attributes are optional. Note: At this time only the PurchasingCardData.InvoiceNumber field is returned in the response. |

|

O |

HG |

||

- Name |

M |

A |

|

- Value |

M |

A |

|

- Flags |

O |

G |

|

- -DoNotPersist |

O |

G |

|

O |

HG |

||

- Name |

M |

A |

|

- Value |

M |

A |

|

O |

- |

Aimed at P2PE scenarios where the device/PED implements a P2PE scheme supported by ACI, yet eSocket.POS does not drive the device/PED (e.g. fuel forecourts). |

|

- Scheme |

M |

- |

This subfield is only mandatory if the PanReference field is present. |

- Ksn |

O |

- |

|

- Data |

O |

- |

|

O |

- |

||

O |

- |

||

O |

- |

||

O |

- |

||

O |

- |

Aimed at P2PE scenarios where the device/PED implements a P2PE scheme supported by ACI, yet eSocket.POS does not drive the device/PED (e.g. fuel forecourts). |

|

- Scheme |

M |

- |

This subfield is only mandatory if the PassThruVolatileP2peData field is present. |

- Ksn |

O |

- |

|

- Data |

O |

- |

|

O |

- |

||

O |

- |

||

O |

- |

||

O |

- |

||

O |

C |

Will be provided in the response if the chained transaction information could be retrieved. |

|

- |

C |

Will be provided in the response if available when an EMV card was used. EMV Tag ID: 9F02 |

|

- |

C |

Will be provided in the response if available when an EMV card was used and a cashback amount was requested. EMV Tag ID: 9F03 |

|

- |

C |

Will be provided in the response if available when an EMV card was used. EMV Tag ID: 4F |

|

- |

C |

Will be provided in the response if available when an EMV card was used. EMV Tag ID: 82 |

|

- |

C |

Will be provided in the response if available when an EMV card was used. EMV Tag ID: 50 |

|

- |

C |

Will be provided in the response if available when an EMV card was used. This field will only be supplied in the xml interface if all characters can be represented as ASCII. Note: This field has been deprecated - please use either EmvApplicationPreferredNameRaw or EmvApplicationPreferredNameInternational. EMV Tag ID: 9F12 |

|

- |

C |

Will be provided in the response if available when an EMV card was used. EMV Tag ID: 9F12 |

|

- |

C |

Will be provided in the response if available when an EMV card was used. This field will only be provided if the Java Virtual Machine (JVM) in which eSocket.POS is running supports conversion from ISO/IEC 8859 using the code page specified by the EmvIssuerCodeTableIndex. EMV Tag ID: 9F12 |

|

- |

C |

Will be provided in the response if available when an EMV card was used. EMV Tag ID: 9F36 |

|

- |

C |

Will be provided in the response if available when an EMV card was used. EMV Tag ID: 9F07 |

|

- |

C |

Will be provided in the response if available when an EMV card was used. EMV Tag ID: 9F26 |

|

- |

C |

Will be provided in the response if available when an EMV card was used. EMV Tag ID: 9F27 |

|

- |

C |

Will be provided in the response if available when an EMV card was used. EMV Tag ID: 8E |

|

- |

C |

Will be provided in the response if available when an EMV card was used. EMV Tag ID: 9F34 |

|

- |

C |

Will be provided in the response if available when an EMV card was used. EMV Tag ID: 9F1E |

|

- |

C |

Will be provided in the response if available when an EMV card was used. EMV Tag ID: 9F0D |

|

- |

C |

Will be provided in the response if available when an EMV card was used. EMV Tag ID: 9F0E |

|

- |

C |

Will be provided in the response if available when an EMV card was used. EMV Tag ID: 9F0F |

|

- |

C |

Will be provided in the response if available when an EMV card was used. EMV Tag ID: 9F10 |

|

- |

C |

Will be provided in the response if available when an EMV card was used. EMV Tag ID: 9F11 |

|

- |

C |

Will be provided in the response if available when an EMV card was used. |

|

- |

C |

Will be provided in the response if available when an EMV card was used. |

|

- |

C |

Will be provided in the response if available when an EMV card was used. |

|

- |

C |

Will be provided in the response if available when an EMV card was used. |

|

- |

C |

Will be provided in the response if available when an EMV card was used. |

|

- |

C |

Will be provided in the response if available when an EMV card was used. EMV Tag ID: 9F09 |

|

- |

C |

Will be provided in the response if available when an EMV card was used. EMV Tag ID: 9F33 |

|

- |

C |

Will be provided in the response if available when an EMV card was used. EMV Tag ID: 9F1A |

|

- |

C |

Will be provided in the response if available when an EMV card was used. EMV Tag ID: 9F35 |

|

- |

C |

Will be provided in the response if available when an EMV card was used. EMV Tag ID: 95 |

|

- |

C |

Will be provided in the response if available when an EMV card was used. EMV Tag ID: 9F53 |

|

- |

C |

Will be provided in the response if available when an EMV card was used. EMV Tag ID: 5F2A |

|

- |

C |

Will be provided in the response if available when an EMV card was used. EMV Tag ID: 9A |

|

- |

C |

Will be provided in the response if available when an EMV card was used. EMV Tag ID: 9F41 |

|

- |

C |

Will be provided in the response if available when an EMV card was used. EMV Tag ID: 9B |

|

- |

C |

Will be provided in the response if available when an EMV card was used. EMV Tag ID: 9C |

|

- |

C |

Will be provided in the response if available when an EMV card was used. EMV Tag ID: 9F37 |

|

- |

C |

Will be provided in the response if available when an EMV card was used. EMV Tag ID: 9F6E |

|

O |

C |

Will be provided in the response if available when an EMV card was used. EMV Tag ID: 9F7C |

|

O |

C |

Will be provided in the response if available when an EMV card was used. EMV Tag ID: 9F40 |

|

- |

C |

Will be provided in the response if available when an EMV card was used. EMV Tag ID: 9F21 |

|

- |

C |

Will be provided in the response if available when an EMV card was used. EMV Tag ID: 87 |

|

- |

C |

Will be provided in the response if available when an EMV card was used. EMV Tag ID: 5F28 |

|

- |

C |

Will be provided in the response if available when an EMV card was used. EMV Tag ID: 5F24 |

|

- |

C |

Will be provided in the response if available when an EMV card was used. |

|

O |

C |

The full response text as sent by the EBT provider. |

|

O |

C |

The beginning food stamp account balance. |

|

O |

C |

The ending food stamp account balance. |

|

O |

C |

The available food stamp account balance. |

|

O |

C |

The beginning Cash Benefits account balance. |

|

O |

C |

The ending Cash Benefits account balance. |

|

O |

C |

The available Cash Benefits account balance. |

|

O |

C |

EBT Case Number. |

|

O |

C |

EBT Voucher Number. |

|

O |

A |

||

- |

C |

The Visa Available Offline Spending Amount value, if available on the card. |

|

- |

C |

Represents the amount of offline spending available on the Card. |

|

O |

H |

The payee name and address object contains identification and billing information for the payee. |

|

O |

H |

Contains additional payee name and address details. |

|

O |

H |

Contains account details needed for a credit application. |

|

O |

H |

The status response from ADS based on the processor specification. |

|

O |

H |

The status response containing information about the account. |

|

G |

G |

Contains additional card details, as configured in eSocket.POS. |

|

G |

G |

Contains information regarding the status of eSocket.POS that serves the terminal. |

1.2.3. EspMerchandise

Merchandise transactions, including telephone prepay, are performed using an EspMerchandise object in the API, or an Esp:Merchandise __ element in the XML interface. The properties should be set according to the rules set out in the following table.

(Properties that are sub-elements with their own properties are indicated in bold text, while properties that are not elements appear in a normal font. Please refer to Object and Property Conditions for an explanation of the Cond and Rsp columns of this table.)

| Property | Cond | Rsp | Description |

|---|---|---|---|

M |

A |

||

M |

A |

||

M |

A |

||

O |

A |

||

O |

A |

||

O |

A |

||

O |

H |

||

O |

H |

||

C |

C |

Should be sent in a referral when an authorization number is provided, for instance after calling an authorization center. Will be present in a response if set by the authorizer of the transaction. |

|

O |

T |

||

O |

C |

||

C |

C |

Should be sent when a token-based authentication is used by the upstream entity. |

|

O |

C |

||

- |

A |

||

M |

A |

Required if the merchandise type is REQUEST or PROCURE. |

|

O |

C |

||

CG |

H |

For merchandise requests requiring the user to be identified, either the UserId or the Track2 property must be set, or these must be obtained by eSocket.POS. |

|

CG |

- |

For merchandise requests requiring the user to be identified, either the UserId or the Track2 property must be set, or these must be obtained by eSocket.POS. |

|

O |

G |

||

O |

- |

||

O |

- |

||

O |

- |

||

- |

H |

||

O |

G |

||

- |

A |

||

- |

A |

||

O |

A |

||

O |

H |

May be set in a request if the Type is CONFIRM or REVERSE. In this case it should match the value in the original REQUEST or PROCURE response. |

|

- |

H |

||

- |

H |

||

- |

H |

||

- |

H |

||

- |

H |

||

- |

H |

||

- |

H |

||

- |

H |

||

- |

H |

||

- |

H |

||

- |

H |

||

- |

H |

||

- |

H |

||

- |

H |

||

- |

H |

||

- |

H |

||

- |

H |

||

- |

H |

||

- |

H |

||

- |

H |

||

- |

H |

||

- |

H |

||

- Quantity |

- |

H |

|

- |

H |

||

- |

H |

||

- |

H |

||

- |

H |

||

O |

HG |

||

- Name |

M |

A |

|

- Value |

M |

A |

|

- Flags |

O |

G |

|

- -DoNotPersist |

O |

G |

|

O |

HG |

||

- Name |

M |

A |

|

- Value |

M |

A |

|

O |

C |

Will be provided in the response if the chained transaction information could be retrieved. |

1.2.4. EspCheck

Check/Cheque transactions are performed using an EspCheck object in the API, or an Esp:Check element in the XML interface. The properties should be set according to the rules set out in the following table.

(Properties that are sub-elements with their own properties are indicated in bold text, while properties that are not elements appear in a normal font. Please refer to Object and Property Conditions for an explanation of the Cond and Rsp columns of this table.)

| Property | Cond | Rsp | Description |

|---|---|---|---|

M |

A |

||

M |

A |

||

M |

A |

||

O |

C |

Can be set to indicate AUTHADV, TRANREQ or CONFIRM message type in requests. Value in response is set based on the request value. |

|

C |

T |

Must be set to true for a reversal. The default (if this property is not set) is false . |

|

O |

A |

||

O |

C |

Defaults to ADVICE (offline). |

|

O |

A |

||

O |

A |

||

O |

A |

||

O |

H |

||

O |

H |

||

C |

C |

Should be sent in a referral when an authorization number is provided, for instance after calling an authorization center. Will be present in a response if set by the authorizer of the transaction. |

|

C |

C |

Should be sent when a token-based authentication is used by the upstream entity. |

|

- |

A |

||

O |

H |

||

O |

C |

||

O |

- |

||

C |

TC |

Should be set if a check ID card is used. Will be present in the response if this property was present in the request or eSocket.POS populated the value while processing the request. If eSocket.POS is configured to mask sensitive data, it will send the first 6 digits and the last 4 digits of the CardNumber |

|

C |

TC |

Should be set if a check ID card is used. Will be present in the response if this property was present in the request or eSocket.POS populated the value while processing the request. |

|

O |

TCG |

May be set if the CardNumber or Track2 is set. Should not be set otherwise. |

|

C |

TCG |

Must be set if CardNumber and ExpiryDate are not set and a check ID card is used. Optional otherwise. Will be present in the response if this property was present in the request or eSocket.POS populated the value while processing the request. If eSocket.POS is configured to mask sensitive data, it will send the first 6 digits and the last 4 digits of the PAN in track2 in the clear and will mask the middle remainder of the PAN as well as the service restriction code and discretionary data in the response. |

|

O |

A |

May be set if the CardNumber is set. Should not be set otherwise. If not set, this value will be set by the PAN component based on the presence or absence of track 2 data . |

|

O |

T |

||

O |

G |

||

O |

A |

||

- |

A |

||

O |

A |

||

M |

A |

||

- |

C |

Will be returned if Track 2 Data is available. |

|

- |

G |

Will be returned if set up by a response pipeline component in eSocket.POS. |

|

O |

|||

O |

H |

Should be set to true if this is a Check ID Card transaction. Default is false . |

|

O |

H |

Should be set to true if the ID was validated against a second ID. Default is false . |

|

O |

H |

||

O |

H |

||

O |

H |

||

O |

H |

||

O |

H |

||

C |

H |

Must be set if a driver’s license is used as the form of identification. |

|

O |

H |

||

C |

H |

Must be set if a generic ID is used as the form of identification. |

|

O |

H |

||

O |

HG |

||

- Name |

M |

A |

|

- Value |

M |

A |

|

- Flags |

O |

G |

|

- -DoNotPersist |

O |

G |

|

O |

HG |

||

- Name |

M |

A |

|

- Value |

M |

A |

|

O |

- |

May be set in order to send level 2 and 3 details for a transaction involving a purchasing card. Within this element, all attributes are optional. |

|

O |

C |

Will be provided in the response if the chained transaction information could be retrieved. |

|

O |

H |

||

O |

H |

||

O |

H |

||

O |

H |

||

O |

H |

||

O |

H |

||

O |

H |

||

O |

H |

||

O |

H |

||

O |

H |

||

O |

H |

||

O |

H |

||

O |

H |

||

O |

H |

||

O |

H |

||

O |

H |

||

O |

H |

||

O |

H |

||

O |

H |

||

O |

H |

||

O |

H |

||

O |

H |

||

O |

H |

1.2.5. EspReconciliation

Batch Cutovers are performed using an EspReconciliation object in the API, or an Esp:Reconciliation element in the XML interface. The properties should be set according to the rules set out in the following table.

(Properties that are sub-elements with their own properties are indicated in bold text, while properties that are not elements appear in a normal font. Please refer to Object and Property Conditions for an explanation of the Cond and Rsp columns of this table.)

| Property | Cond | Rsp | Description |

|---|---|---|---|

M |

A |

||

M |

A |

||

O |

C |

||

O |

G |

||

O |

A |

||

O |

A |

||

O |

A |

||

O |

HG |

||

- Name |

M |

A |

|

- Value |

M |

A |

|

- |

A |

||

- |

A |

||

- |

A |

9670 - ' Batch Totals Not Available ', if there was any condition that the totals was not retrieved from Postilion Realtime |

|

O |

C |

In the request, contains the Number of Credit transactions processed by the terminal in the batch, if available. In the response, contains the Number of Credit transactions processed by Postilion Realtime for this terminal, if available. |

|

O |

C |

In the request, contains the Number of Reversal Credit transactions processed by the terminal in the batch, if available. In the response, contains the Number of Reversal Credit transactions processed by Postilion Realtime for this terminal, if available. |

|

O |

C |

In the request, contains the Number of Debit transactions processed by the terminal in the batch, if available. In the response, contains the Number of Debit transactions processed by Postilion Realtime for this terminal, if available. |

|

O |

C |

In the request, contains the Number of Debit Reversal transactions processed by the terminal in the batch, if available. In the response, contains the Number of Debit Reversal transactions processed by Postilion Realtime for this terminal, if available. |

|

O |

C |

In the request, contains the Number of Inquiry transactions processed by the terminal in the batch, if available. In the response, contains the Number of Inquiry transactions processed by Postilion Realtime for this terminal, if available. |

|

O |

C |

In the request, contains the Number of Authorization transactions processed by the terminal in the batch, if available. In the response, contains the Number of Authorization transactions processed by Postilion Realtime for this terminal, if available. |

|

C |

C |

Should be sent when a token-based authentication is used by the upstream entity. |

|

O |

C |

In the request, contains the total amount of all Credit transactions processed by the terminal in the batch, if available. In the response, contains the total amount of all Credit transactions processed by Postilion Realtime for this terminal, if available. |

|

O |

C |

In the request, contains the total amount of all Credit Reversal transactions processed by the terminal in the batch, if available. In the response, contains the total amount of all Credit Reversal transactions processed by Postilion Realtime for this terminal, if available. |

|

O |

C |

In the request, contains the total amount of all Debit transactions processed by the terminal in the batch, if available. In the response, contains the total amount of all Debit transactions processed by Postilion Realtime for this terminal, if available. |

|

O |

C |

In the request, contains the total amount of all Debit Reversal transactions processed by the terminal in the batch, if available. In the response, contains the total amount of all Debit Reversal transactions processed by Postilion Realtime for this terminal, if available. |

|

O |

C |

In the request, contains the net of all gross debit and gross credit amounts for transactions processed by the terminal in the batch, if available. In the response, contains the net of all gross debit and gross credit amounts for transactions processed by Postilion Realtime for this terminal, if available. |

|

M |

A |

||

M |

A |

||

O |

HG |

||

- Name |

M |

A |

|

- Value |

M |

A |

|

- Flags |

O |

G |

|

- -DoNotPersist |

O |

G |

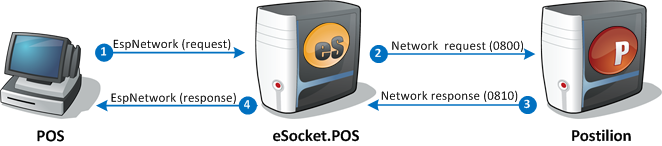

1.2.6. EspNetwork

Network Management is performed using an EspNetwork object in the API, or an Esp:Network element in the XML interface. The properties should be set according to the rules set out in the following table.

(Properties that are sub-elements with their own properties are indicated in bold text, while properties that are not elements appear in a normal font. Please refer to Object and Property Conditions for an explanation of the Cond and Rsp columns of this table.)

| Property | Cond | Rsp | Description |

|---|---|---|---|

M |

A |

||

M |

A |

||

O |

A |

||

O |

A |

||

O |

A |

||

- |

A |

||

- |

A |

||

- |

A |

||

O |

G |

||

O |

H |

||

M |

H |

||

G |

A |

Required if the message will be sent to Transaction Manager, unless this is populated by a pipeline component. |

|

- |

G |

Will be returned if set up by a response pipeline component in eSocket.POS. |

|

O |

HG |

||

- Name |

M |

A |

|

- Value |

M |

A |

|

- Flags |

O |

G |

|

- -DoNotPersist |

O |

G |

|

O |

HG |

||

- Name |

M |

A |

|

- Value |

M |

A |

|

C |

C |

Should be sent when a token-based authentication is used by the upstream entity. |

|

O |

H |

Contains data passed from the Point-of-Service (POS) system. |

|

M |

A |

||

M |

A |

||

M |

A |

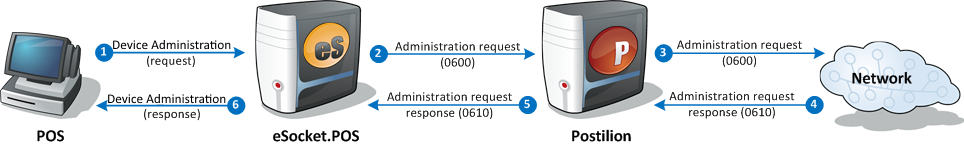

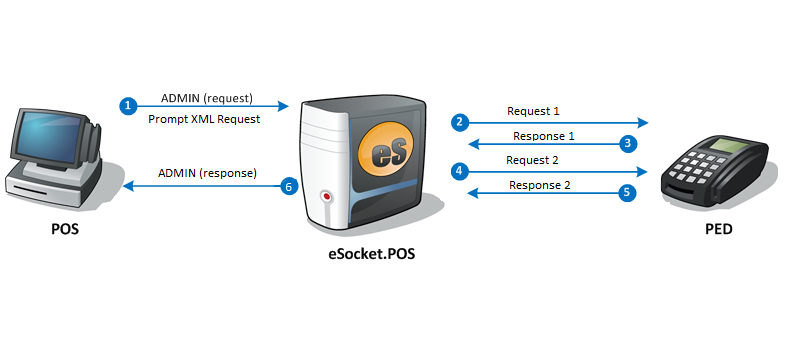

1.3. Interface Specification - Administrative

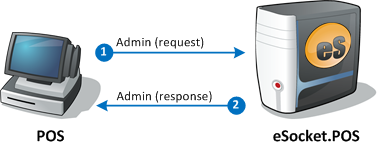

1.3.1. EspAdmin

Administrative functions are performed using the init , close and closeAll methods in the API, or an Esp:Admin element in the XML interface. The properties should be set according to the rules set out in the following table.

(Please refer to Object and Property Conditions for an explanation of the Cond and Rsp columns of this table.)

| Property | Cond | Rsp | Description |

|---|---|---|---|

M |

A |

||

M |

A |

||

- |

A |

||

- |

A |

||

O |

- |

One or more register elements |

|

- Type |

M |

- |

|

- EventId |

M |

- |

1.3.2. EspEvent

Callbacks are performed using the onEvent method in the API, or an Esp:Event element in the XML interface. The properties should be set according to the rules set out in the following table.

(Please refer to Object and Property Conditions for an explanation of the Cond and Rsp columns of this table.)

| Property | Cond | Rsp | Description |